Frequently Asked Questions

How do I enroll in online banking?

How do I reset my online banking password?

Submitting this form will generate a new, random password for your account.

- The new password will be mailed to you at the email address currently on file for home banking.

- If there is no email address already saved for this account, OR

- If this account has never successfully been logged into, OR

- If the account has been locked by the Credit Union, please contact the Credit Union for assistance.

What are your hours?

9:00am – 5:15pm (Ridley Park)

9:00am – 5:00pm (Glen Mills)

Friday

7:30am – 5:15pm (Ridley Park)

9:00am – 5:00pm (Glen Mills)

Saturday

9:00am – 12:00pm (Ridley Park & Glen Mills)

Do I need to live in Delaware County to be eligible to open up an account?

Can I open an account online?

- Your Social Security Number

- A U.S. government-issued photo ID (e.g. Driver License, Passport, State or Military ID)

- The credit union deposits the initial funds for you to become a member. You will need a credit or debit card or U.S. checking or savings account to add additional funds to your account(s)

How do I set up my digital wallet?

- How to use the wallet

- What devices are compatible with the wallet

- What merchants allow the wallet for payment, although this varies by store and POS.

Apple Pay:

http://www.apple.com/apple-pay/

How to load a card in Apple Pay: https://support.apple.com/en-us/HT204506

How to pay with an iPhone: http://www.apple.com/apple-pay/

Google Pay:

https://pay.google.com/about/

Shows how to load a card: https://support.google.com/pay/answer/7625139?co=GENIE.Platform%3DAndroid&oco=1

There are options to load a card via “Computer, Android, or iPhone & iPad”. Google Pay doesn’t work as a wallet on Apple devices. Google pay on an Apple device would just be a way to send money. As of Oct. 2018, Google Pay is available on all non-rooted Android devices (Lollipop 5.0+).

Google Play Store: https://play.google.com/store/apps/details?id=com.google.android.apps.walletnfcrel

Google Pay on an Apple device: Google Pay can only be used to transfer money and to pay online. It doesn’t load a card to use as a wallet. To test/use Google Pay, it needs to be used on a Samsung/Android device.

Samsung Pay:

http://www.samsung.com/us/samsung-pay/

Shows how to load a card: https://www.samsung.com/us/support/answer/ANS00045081/

- Scroll down the page, it says “Set Up Samsung Pay”. There are links there to install Samsung Pay and a different link to “set up Samsung Pay”.

Fitbit:

https://www.fitbit.com/fitbit-pay

Garmin:

https://explore.garmin.com/en-US/garmin-pay/

Setting Up the wallet: https://www8.garmin.com/manuals/webhelp/vivoactive3/EN-US/GUID-109340CD-8504-4FA8-9E70-83A071C6CC86.html

FitPay: http://www.fit-pay.com/

How do I find surcharge free ATM’s or branches on the Co-Op Network?

How do I set up external accounts using online banking?

User Set Up For External Account Transfers:

The user logs into their account and goes to ‘transfer>external account transfer>add account’. Fill out the form with their outside financial institution account information.

Once they complete the required information it will generate a ‘micro-deposit’ to be retrieved and processed as an ACH file by cu staff through the admin site. Micro-deposits are the means that HomeCU uses to establish account ownership of the account the user has requested access to.

Micro deposits will always need to be confirmed by the user to establish that the requested outside financial institution account belongs to the user.

Once the cu staff processes the ACH file the user should wait a couple of days and then go review the account at the outside financial institution for the micro deposit amounts. If the micro-deposit processes correctly the user should see a deposit and withdrawal on their account. They should make a note of the amount of the micro-deposit. Now that the micro-deposit has posted to their outside account they will need to log back into their account at the credit union, and click on the menu ‘transfer>external account transfer’. They will see their external accounts sitting in there with a ‘pending verification’ status on them.

The user should click on the flag to bring up a verification screen, and proceed to fill this form out with the correct micro-deposit amounts they have retrieved from their outside financial institution. Once the micro-deposit is verified correctly, the status will change to ‘active’ and the user can proceed to transfer money to and from the outside financial institution using the normal transfer screen on their account. Users can also request transfers directly to a loan payment.

Users can also click on the pen at the far left to edit the names on the account if desired. The name they place here will show up as the external account description on their transfer screen.

There is no time limit on a micro deposit confirmation. Accounts can get locked when confirming the micro deposit amounts from their outside financial institution. The user has 5 attempts to confirm the correct micro deposit amount and if they repeatedly input the wrong amount they can lock the record.

A locked record will show up with a red lock icon. Once locked micro deposit confirmations cannot be unlocked, and the member must delete the original request and start over.

Administration For External Account Transfers:

ACH MENU: Allows credit union staff to manage user generated ACH transaction requests. ACH transactions are generated by users when they:

1) Setup an External Account which generates a micro-deposit

2) Request ACH transactions via their online banking

When members set up their External Account, ACH transactions are created to initiate the micro-deposits for account verification. An offsetting ACH to pull back the micro deposit is also created if the cu indicates to do so under ‘Administrative Maintenance>Banking Settings>ACH>Create Offsetting Micro Deposit Entry’.

ACH ACTIONS:

The credit union will create the ACH transmission file which is then uploaded to their corporate account for processing.

First, pending transactions are reviewed by the credit union staff and selected. If you do not select certain transactions they will remain in the ACH Actions as a pending item to be processed later.

Next, choose from the drop down to ‘Create ACH Upload File’, the selected items will be processed and placed in a *.ach(Batch_YYMMDD_HHmm.ach) file and download this to the admin users PC or MAC. This *.achfile is then uploaded to the credit unions corporate account for processing.

If you choose to ‘Cancel Transactions’ those selected will be permanently deleted.

Once your members verify their micro deposits you will see both new ACH micro deposits and real transfer requests in the pending transactions.

ACH HISTORY:

This link will show previously processed ACH transaction files. Including process date and time, credit union staff who processed the file and the transaction count in the file. The down arrow to the right allows credit union staff to open and view the actual ACH formatted file.

The page icon to the right will allow credit union staff open and see the details of the file.

If needed, the cu staff can click on the actual row to see the detail of the user accounts in the selected file.

Once the file details are open, credit union staff can remove any transactions they desire by choosing the box to the left of the transaction and clicking remove. This is typically only done if the ACH transaction is rejected by the outside financial institution or the Federal Reserve for some reason (bad account number, account not found, etc).

If credit union staff removes a transaction from an ACH file that has already been posted it will generate a new ACH file from the transaction removed.

Staff can then review the new file in Actions and cancel the transaction if needed.

NOTES:

PROFILES:

The confirmation flag when setting up a profile indicates that if any group assigned to that profile has more than one user in it, when an actual transfer is done another user will need to confirm the transfer. Not the initial micro deposit confirmation, but any further real external transfers. If there is only one user in a group then this rule does not apply.

Credit unions wishing to use the EFT functionality must be ACH originators. Typically through their corporate account.

How do I make deposits into my iSAVE Savings account?

- ACH distribution

- Scheduled transfers

- For new iSAVE Savings accounts, BHCU must verify “new money” is coming in to another BHCU account in order to proceed with setting up the scheduled transfer. If we don’t see that it’s being scheduled from new money, we cannot set it up until we see it.

- In the rare occurrence of a member still receiving live checks, setting up a scheduled transfer will be the solution to fulfilling the monthly automatic deposit requirement.

- Direct Deposit (ACH) from payroll, pension, Social Security, etc.

- Pulled funds from another institution

- In branch deposits

- New Cash

- New Checks

Unacceptable Monthly Deposits:

- Online Banking transfers

- Scheduled Online Banking transfers

- Manual transfers (internally)

- Example: A member comes into the branch to deposit $100 into their checking account but decides they wanted half to go into the iSAVE Savings. We can no longer transfer this and needs to be completed by withdrawing cash and depositing cash.

New Money:

***Due to Online Banking transfers being rejected, a member can call us for unique situations to process the deposit. For example, a member deposits wedding checks into their checking account but wants to move half of it over to iSAVE Savings. They would need to call us, we would then recognize the new money, withdrawal cash, and deposit cash into the iSAVE Savings account to avoid rejection from the iSAVE program.

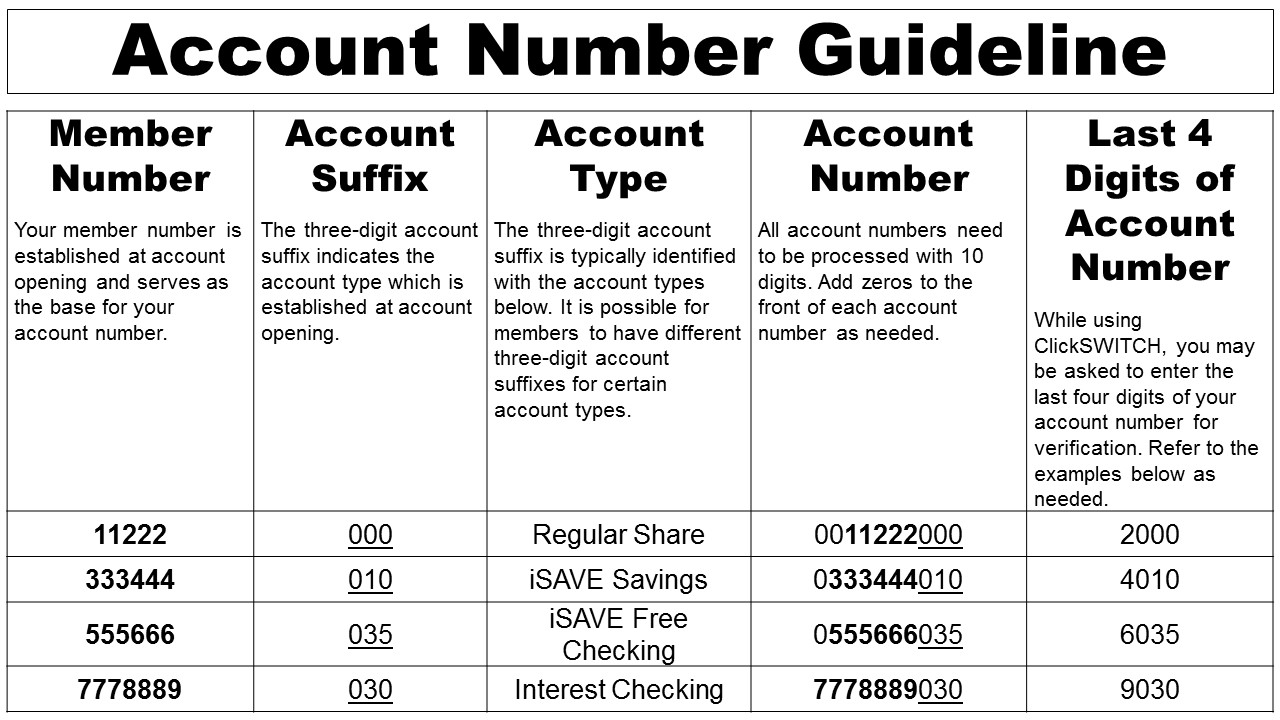

How do I determine my account number?